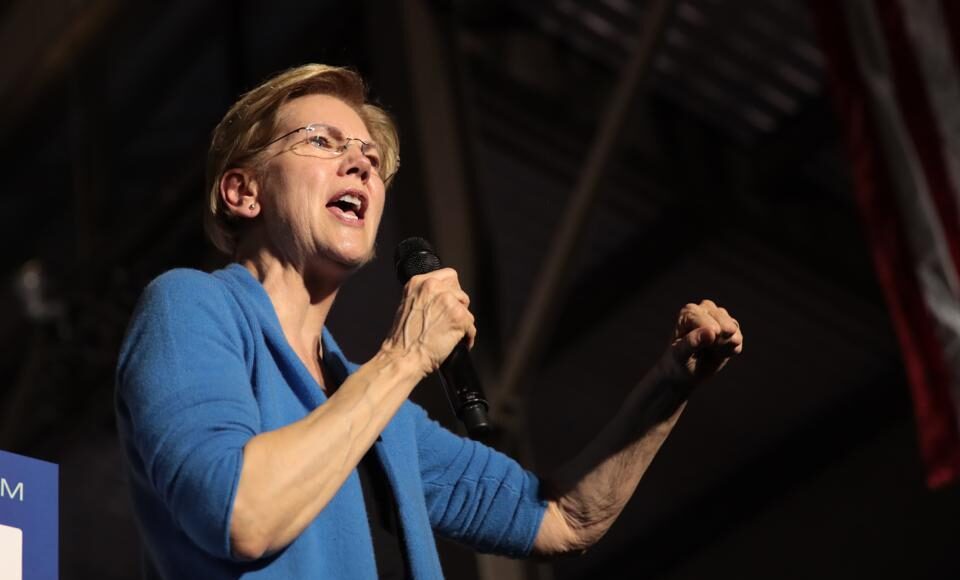

Democratic lawmakers, including Sen. Elizabeth Warren (Mass.) and Rep. Katie Porter (Calif.), released legislation Tuesday to repeal a set of Trump-era policies that loosened regulations on small and medium-sized banks, NBC News reported, following the collapse of three regional banks in less than a week—though the push for stricter rules faces long odds in a GOP-controlled House.

The legislation, which was proposed in the House and the Senate, would repeal a 2018 policy signed by former President Donald Trump that loosened some financial regulations that had been imposed under the 2010 Dodd-Frank Act—which itself was passed after the Great Recession.

The bill focuses on a provision in the 2018 law that said only banks with over $250 billion in assets are subject to enhanced requirements including stress tests, stricter capital requirements and risk management practices, up from the Dodd-Frank Act’s $50 billion threshold.

Warren had blasted the 2018 bill—which was led by Republicans but backed by dozens of House and Senate Democrats—in a New York Times op-ed published Monday morning, calling on Congress to restore the provisions in the act.

It follows the failure of California-based Silicon Valley Bank, which was closed by state regulators Friday, as well as the closure of New York-based Signature Bank, which was shuttered on Sunday, both of which had assets above $50 billion but below $250 billion.

The bill is still a longshot in the GOP-controlled House of Representatives. House Financial Services Chair Patrick McHenry (R-N.C.) said Sunday he has “confidence” in the current regulations, and Senate Banking Committee ranking member Tim Scott (R-S.C.), has argued “a culture of government intervention does nothing” to prevent banks from relying on the government to “swoop in after taking excessive risks.” Former President Donald Trump’s spokesperson Steven Cheung also blasted Democrats, arguing they had attempted to hide their “failures with desperate lies,” telling Bloomberg they tried to “gaslight the public to evade responsibility.”

Greg Becker, who served as CEO of Silicon Valley Bank before its collapse, had lobbied members of Congress to repeal provisions of the Dodd-Frank Act three years before Trump signed the repeal into law in 2018. Becker said at the time the restrictions on small banks under the Dodd-Frank Act were too burdensome and inhibited banks’ ability to “provide the banking services our clients need,” arguing that the $50 billion threshold needed to be raised.

“Washington is about to make it easier for banks to run up risk, make it easier to put our constituents at risk, make it easier to put American families in danger just so that the CEOs and these banks can get a new corporate jet and add another floor to their new corporate headquarters,” Warren warned on the Senate floor before the passage of the 2018 bill. The senator reiterated that warning verbatim while introducing the new legislation to restore Dodd-Frank’s regulations Tuesday, saying, “I wish I had been wrong.”

Silicon Valley Bank, a tech-friendly regional bank based in Santa-Clara, California, abruptly collapsed Friday, two days after the bank announced it had lost $1.8 billion in the sale of $21 billion in securities—a last-ditch effort to quickly raise money as many of its big-money customers looked to withdraw their deposits. The collapse has been linked to the Federal Reserve’s push to stem inflation by hiking interest rates, which caused many of the Treasuries and other assets held by SVB to lose value. News of the bank’s losses prompted a massive bank run as depositors continued to withdraw their money, spooking investors and shaking Wall Street. SVB’s share price fell nearly 25% Friday before the bank was shuttered by California state regulators. The FDIC also pledged on Sunday to make depositors at SVB—including tech companies like Roku, Circle and Roblox—whole, even if they deposited more than the $250,000 typically insured by the federal government.

SVB’s collapse also sent shockwaves throughout the market, including the 10 biggest banks in the U.S., which have suffered more than $185 billion in market value losses since Wednesday. On Sunday, New York regulators closed another regional bank—crypto-friendly Signature Bank—as customers withdrew large amounts of money after its shares fell more than 32% between Wednesday and Friday.

The Securities and Exchange Commission and the Department of Justice have reportedly launched investigations into SVB’s collapse, though sources told the Wall Street Journal Tuesday the investigations will not necessarily result in charges against the bank.

Democrats Blame SVB Collapse On Trump-Era Regulatory Rollbacks—But GOP Opposes Stricter Rules (Forbes)

What To Know About Silicon Valley Bank’s Collapse—The Biggest Bank Failure Since 2008 (Forbes)

What Happened To Signature Bank? The Latest Bank Failure Marks Third Largest In History (Forbes)