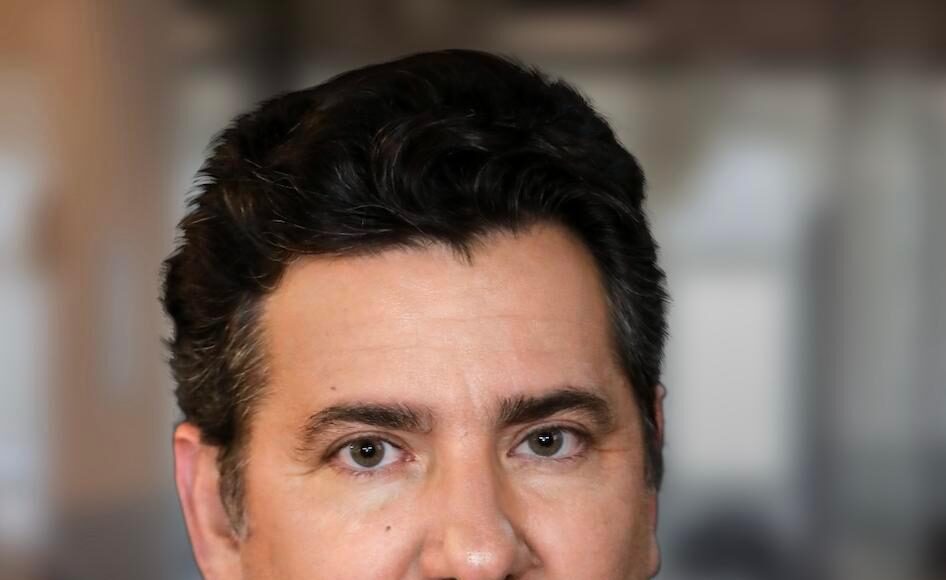

Inlate February, Infinite Reality’s cofounder and CEO John Acunto ran onto a sprawling stage at a studio space in Los Angeles to make a bombastic, if defensive-sounding, speech. “The bullshit factor is gone,” proclaimed the 53-year-old Acunto, illuminated by a neon blue backdrop. “Do you really think that we would talk about $3 billion dollar investments and be one of the largest companies in our space if we really weren’t doing what we’re doing?” he continued according to a video of the investor event reviewed by Forbes. “Today is your celebration of giving us the capital. Stand up and clap for yourselves. … You built a $12 billion company!” Infinite Reality’s chief business officer, Amish Shah, took it a step further, gushing to the audience of around 100 shareholders, “Our goal is to build a $50 to $100 billion dollar company this year.”

Bold ambition? More like baffling—and deeply implausible. Acunto and his company faced a string of lawsuits from creditors who say they are chasing unpaid bills. There is a federal lawsuit to enforce compliance with a subpoena from the Securities and Exchange Commission. Acunto’s ballyhooed $3 billion investment—which “could easily rank as one of the largest venture rounds of the year,” according to Song Ma, professor of finance at Yale’s business school—supposedly came from just one anonymous investor. Only five companies—mostly AI firms, and all high-profile—are known to have raised more money in the last year: OpenAI, Anthropic, xAI, Databricks and Waymo, per PitchBook. In mid-April Infinite Reality raised its valuation to $15.5 billion after making an all-stock acquisition of an AI avatar company. That seems out of this world. Infinite Reality—which only recently launched its core product, a tool to turn websites into 3D “virtual storefronts”—says it brought in $75 million in revenue in 2024, up from $50 million in 2023. That would mean it’s worth 200 times its revenue, a far higher multiple than the hottest AI startups: Anthropic (worth an estimated 44x revenue) and OpenAI (estimated 24x).

When a venture-backed startup announces a large investment or fundraising round like this one, there is scant requirement for verification or documentation. Only the company and its investors are required to know the terms of the deal, though the SEC has broad oversight over any transaction of securities and can demand more information—which they have already done with Infinite Reality after it proclaimed it could be worth $1.85 billion in December 2022.

Over the past few years, venture money has poured into tech startups at an extraordinary pace. Ten years ago, the total raised by tech firms was $87 billion; five years ago, it was $175 billion; by last year it had exploded to $209 billion. That’s a lot of cash flying around and much of it is being invested in obscure startups that few outside of the industry have ever heard of. Interestingly, one area that has seen declining interest from venture capitalists over the past few years is metaverse-focused startups like Infinite Reality. Blame Mark Zuckerberg’s epic failure. Since 2020, Meta has blown more than $50 billion trying to build a persistent, virtual world that he termed the “metaverse,” even going so far as to rename Facebook as Meta in 2021. But the effort has largely been a bust, plagued by technical glitches (think avatars with no legs) and limited user interest. Meta’s main metaverse product, Horizon Worlds, had fewer than monthly 200,000 users in 2022, according to the Wall Street Journal, the last time anyone reported the number. Overall, venture capital and growth equity funding for metaverse firms fell from $5.6 billion to just $1.4 billion between 2022 and 2024, according to PitchBook data. Which makes the amount raised by Infinite Reality even more unusual.

Nearly all of Infinite Reality’s revenue can be attributed to the dozen or so startups it has acquired since 2022. Those deals have brought the firm some headlines—such as when it announced a deal to buy Napster this spring (despite the name recognition, the Spotify clone is a very different company than it once was and ranks just 27th among music apps on the App Store these days, according to Data.AI). But Infinite Reality is not well known within the industry and the fundraising announcement came as a shock. “No one had heard about it. I also talked with other people around the industry, and they were like, what? Who are they?” says Sara Gherghelas, an analyst with Lithuania-based metaverse and Web3 research firm DappRadar.

The fundraising announcement was also the first time that Herman Narula, founder of metaverse developer Improbable, which was reportedly valued at more than $3 billion after raising money from SoftBank and Andreessen Horowitz, had heard of the startup. “We have run hundreds of metaverse events with some of the biggest brands in the world with tens of thousands of people over the last year. I have thus far never encountered this company either as a supplier, or a customer, nor has any partner mentioned them,” Narula told Forbes. Similarly, Yat Siu—founder of Animoca Brands (one of the most active investors in Web3, metaverse and gaming companies and owner of the Sandbox platform), valued at $5.9 billion in 2022—said the investment “didn’t make any ripples in our industry. … Nobody has spoken to us about it.”

Infinite Reality first emailed Forbes announcing its $3 billion financing round on January 8. It reached out again on February 11, this time pitching Acunto, who then had a 12% stake in the Boca Raton Florida-based company, as a “prime candidate” for Forbes’ billionaires list.

That’s when Forbes began looking into Acunto and Infinite Reality, reaching out to more than 60 investors, industry insiders, partners, customers, VCs, former employees and lawyers; more than 20 responded. Forbes also had multiple calls with Infinite Reality and Acunto. What emerged is a convoluted story of a company in which everything—from its funding and valuation to its investors, customers and even the CEO’s background—only raises more questions.

“There’s a lot of things that are uncommon,” says Karina Kogan, Infinite Reality’s chief marketing officer when asked about the unusual funding round, “but we’re not a common company.”

Acunto’s career has been blighted by questionable credentials and a stack of unpaid bills (now resolved) that goes back more than two decades. A bio provided by an Infinite Reality representative and a 2022 document filed with the SEC claim that he received a doctorate degree in mathematics from the University of Florida and a masters degree in data science from Harvard; neither university has a record of him. Acunto told Forbes that the bio was produced in error because Infinite Reality was short-staffed. “That’s absolutely ridiculous that they took that draft and put it in there.” Perhaps. But the exact same sentence appears in a 2024 document for a school his children attended. Acunto claims he “went to a lot of different schools” but will not say where—or if—he attended college.

“We have run hundreds of metaverse events with some of the biggest brands in the world with tens of thousands of people over the last year. I have thus far never encountered this company.”

Acunto, who was reluctant to talk to Forbes about his past, ran a string of digital advertising and entertainment businesses, none of which amounted to much. They did, however, lead to lawsuits in at least six states, against his former companies and Acunto personally, several of which alleged nonpayment of various bills. Despite judgments being issued, the cases dragged on for years; two were, in fact, resolved in the past year, with Acunto paying $400,000 to settle a 2006 case involving now-defunct advertising business Adsouth and $780,000 related to a 2010 suit involving a transcription software company. Acunto, who moved around over the years, says he didn’t know about the judgments until recently. “Anybody who has sued me probably had in their mind a good reason,” Acunto says. “I don’t have a negative word to say about anybody.”

Infinite Reality’s story begins in 2019, when Acunto and some investors bought a bankrupt New York-based social media company called Tsu, that they renamed Display Social. The business brought in just $150,000 in revenue its first three years combined. According to SEC filings, Display Social somehow managed to raise $44 million by 2021. Forbes reached out to four venture funds listed on PitchBook as early backers of the company that would later become Infinite Reality. None spoke to Forbes; one appears to be out of business.

Armed with stock supposedly backed by the millions in funding, Acunto went shopping. He acquired Thunder Studios, a Long Beach, California-based production company and Norwalk, Connecticut-based Infinite Reality in an all-stock deal for $235 million in January 2022 that valued his company at $1 billion, per an SEC filing. He renamed the combined firm Infinite Reality and then acquired a small eSports company called ReKT in July that year in a $470 million all-stock transaction that doubled Infinite Reality’s valuation, at least according to what the company filed with the SEC. That fall, Infinite Reality filed to go public via a SPAC but ended up pulling it in December 2022 due to turbulent markets, according to Acunto. It filed the paperwork for a new SPAC later that same month, but that deal didn’t happen either.

In 2024, it snapped up more companies in all-stock deals: Drone Racing League ($250 million), a New York-based startup that once had a short-lived ESPN deal but hasn’t staged an event in over two years; Landvault, a London-based advertising group behind such marketing stunts as a virtual Heineken “bar” (that didn’t serve drinks) on a 3D playground ($450 million); Action Face, a bankrupt California-based startup that turns selfies into 3D avatars or small plastic figurines ($10 million) and Los Angeles, California-based Ethereal Engine ($75 million), which allows users to build metaverse-style spaces with less code. Each deal upped Infinite Reality’s self-reported valuation.

“I knew nothing about a funding round and the accompanying announcement. The quote in the press release was not from me.”

By last summer, the company reported a $5.1 billion valuation. “That’s your fake imaginary number you think you’re worth,” said a former executive at one of the acquired companies who was laid off from Infinite Reality in 2024. “I and many of my peers at the organization all looked around and went, ‘Boy, a lot of this feels like a scam.’” Infinite Reality says the merger prices and company valuations are fair. Matthew Schwartz, the Gibson Dunn partner who represented Infinite Reality in these deals, declined to comment.

Throughout this period, Infinite Reality struggled to pay bills on time, according to a handful of nonpayment lawsuits. Investment bank TD Cowen filed in early 2024 over unpaid fees attached to the ReKT acquisition. That case resulted in a $3.25 million judgment against Infinite Reality in December 2024. In another case, a group of shareholders, Summit Investors, accused Infinite Reality of not allowing it to sell shares back to Infinite Reality for over $27 million. Per a complaint filed in December 2022 but amended in January 2025, Infinite Reality asserted that it did “not have the funds ‘or the financing’ to pay all or any portion” of the sum. That case was discontinued in mid-February; “payments are being made,” said Infinite Reality’s chief marketing officer Kogan. Four other contractors or vendors sued for nonpayment in late 2023 and 2024.

“It was very clear [from] my limited interactions that they had very serious cash flow issues, and they had designed their contracts to account for that,” said one former contractor who worked with Infinite Reality. The contractor asked not to be named for fear of retaliation.

Kogan acknowledged the “cash flow problems” in 2023 and 2024, emphasizing that they’re not uncommon for a startup. She added that with the number of acquisitions the company did, it’s not surprising for nonpayment lawsuits and similar issues to “come out of the woodwork,” and that the company is working through them—which takes time, not because they don’t have the cash, but rather because it’s “a lot of paperwork.” Most of the cases have now been withdrawn.

For his part, Acunto dismissed the lawsuits as the cost of doing business. “You’re gonna expect us to have vendor lawsuits. That’s very normal … you know, whatever. Stuff like that happens all the time.”

That fresh funding from Infinite Reality’s new wealthy backer should mean that all those troubles are in the past now. According to chief business officer Shah, the $3 billion round in January from the single investor was actually a multi-step $3.36 billion deal. It started with a $350 million fundraise announced in July 2024 as coming from a multi-family office. It was then followed up with a previously unannounced $500 million in October and the rest in January, apparently all involving the same anonymous investor.

Until recently, Infinite Reality’s website touted that it had “top-tier investors in sports, media, and entertainment” with names like Lerer Hippeau, Lux Capital, the talent agency CAA, Shark Tank guest judge Matt Higgins’ and real estate billionaire Stephen Ross’ RSE Ventures, and Exor, the investment fund for the Italian billionaire Agnelli family. These big-name investors only became Infinite Reality shareholders after it acquired Drone Racing League, which they all had backed. None appeared to invest directly in Infinite Reality.

Lux Capital confirmed it only invested through the Drone Racing League in 2016. CAA and Exor (whose logo was wrong on Infinite Reality’s website) declined to comment. One investor who didn’t want to be quoted said his firm had only heard of the acquisition after it closed, and that Infinite Reality hasn’t been responding to emails or audit questions. The other “top-tier investors” declined to speak to Forbes or did not respond to requests for comment. The investor page of Infinite Reality’s website disappeared after Forbes started contacting the VCs and funds it named.

There is a lot of smoke and mirrors. Infinite Reality hyped the “great things” it did with British soccer team Manchester City at its shareholder meeting. But a spokesperson for Man City emailed Forbes that Infinite Reality is not an “official partner or supplier” and “has no further affiliation with the club.” Rather, a third-party contractor employed Infinite Reality’s subsidiary Thunder Studios for a “small part” of a multi-partner project.

When asked to explain the financials behind his company’s valuation, Acunto responded, “Let me help give you the two and two, then you can figure the four out.” He then touted a “five-year strategic partnership” with Google that “played a large part in the valuation.” He made that same claim at the February investor conference, telling the crowd, “we are supercharging Gemini,” referencing Google’s AI offering. Google has a different take, describing Infinite Reality to Forbes as just an ordinary customer of Google Cloud.

Even Infinite Reality insiders have questions: Cofounder (Infinite Reality has four), shareholder and former board member Rodric David sued for financial documents in December to “understand the valuation” and “evaluate the Company’s adherence to proper corporate governance standards.” Among the requested documents: two bonds presented to shareholders on October 1 valued at $1 billion and $2.5 billion, respectively, and details on the $350 million equity investment in July from a multi-family office. The case was dismissed in March. David told Forbes that Acunto is sending him the documents, which he wanted because he’s trying to sell some of his shares.

Got a tip for us? Contact reporters Phoebe Liu at [email protected], and Iain Martin at [email protected].

After Infinite Reality initially declined to introduce its new investor or reveal their identity, Forbes contacted Michael Sullivan, a partner at Ashcroft, the Boston-based law firm started by former U.S. Attorney General John Ashcroft, who was quoted in Infinite Reality’s press release about the deal. In the release, Sullivan was quoted as saying that the anonymous investor (and Ashcroft client) “was particularly impressed by what he believes is iR’s [Infinite Reality’s] revolutionary product,” which assists in “empowering users and redefining ownership in the digital age.”

Sullivan denied making that statement or having any involvement in the $3 billion fundraise. “I knew nothing about a funding round and the accompanying announcement,” Sullivan wrote to Forbes in a March email. “The quote in the press release was not from me. In fact I had not reviewed or agreed to it when it was first published and made that clear to several folks.”

In a later email to Forbes, Ashcroft managing partner Lori Day confirmed that their “client transferred a total of $3.36 billion U.S. dollars to Infinite Reality,” citing banking transfer receipts (which they declined to show Forbes) but clarified that the firm did not “advise our client on these agreements, or the transaction itself.”

Ashcroft, of course, has no legal duty to investigate the legitimacy of these receipts or even whether the transaction actually occurred, since they weren’t involved in the deal and are not soliciting further investment. The firm doesn’t have any responsibility even to check that their client has the assets to make such a transfer. Their sole duty is to represent the interests of their client, who apparently asked the firm to “publicly verify” the investment.

The only statement provided by the investor appears to be one that was read by Infinite Reality’s cofounder and chief business officer Shah at the February shareholder meeting. Anonymity meant that Infinite Reality wouldn’t be burdened with “unnecessary distractions,” Shah read. “Please know that my confidence in the board and executive team is unwavering, and I am always available through appropriate channels to contribute to strategic discussions or provide additional financial support as needed,” said Shah, reading from the statement.

It’s unclear how much of the reported $3.36 billion raised over the last year is freely available to the company right now. “It’s in an offshore account, and we’re waiting to get it from the offshore account to over here in the States…. That cash will be available and in the States this month,” according to an Infinite Reality executive, who said in March he was not at liberty to speak about confidential financials. Asked again a few minutes later, he responded: “ We should have somewhere over $800 million that should be available in the States in our bank account.” When asked whether Infinite Reality had yet spent any of the funding, Gillian Sheldon, Infinite Reality’s head of communications, wrote that the company has “begun to leverage it.”

That will be helpful, because Infinite Reality is still being hit with nonpayment suits, the latest of which was filed by another contractor in March 2025 alleging nonpayment of around $200,000 by Infinite Reality and its Drone Racing League subsidiary from invoices dated between November 2024 and March 2025. It’s also still making new deals and using them to up its valuation: In mid-April, Infinite Reality announced yet another acquisition, a $500 million deal to buy New York-based startup Touchcast, which has made AI website widgets and avatars for clients like Accenture. That purchase boosted Infinite Reality’s valuation to $15.5 billion, the company announced.

It’s still facing the SEC lawsuit, which was filed in February and alleges that Infinite Reality failed to respond to a subpoena demanding financials to support an earlier $1.85 billion valuation that was part of a scrapped SPAC merger. “The Commission has obtained information showing that certain individuals and/or entities may have been or may be, among other things, making false statements of material fact and omitting to disclose material facts to investors,” stated an attorney with the SEC’s Boston office in the filing. Infinite Reality spokesperson Sheldon wrote to Forbes, “There is no allegation that anyone violated any laws, including at Infinite Reality. We are cooperating with the SEC’s investigation. Once we have complied with the subpoena, we expect the application to be dismissed.”

Infinite Reality’s valuation could get an acid test in the next couple of months thanks to a deal to allow investors to buy and sell shares via Nasdaq Private Markets, a trading platform for unlisted company shares. At the February meeting, Shah said the company already has “a little over a billion dollars of interest” and that trading would start in March. (One shareholder said he still hadn’t been able to sell any shares as of mid-April).

“That’s bizarre,” says Ed Zimmerman, a startup investing lawyer at Lowenstein Sandler, of Infinite Reality’s valuation. “But maybe it’s the greatest company in the world.”

Disclosure: John Acunto, Infinite Reality’s CEO, is writing a book with Forbes Books, a licensed partner of Forbes.